Continuing a series I started last month on real estate tips for pro athletes, this piece discusses how athletes can take ownership of property. The most common real estate people own, including athletes, is their house, and they frequently hold that in their individual names. However, owning property in your individual capacity has certain problems, including little liability protection and potential headaches for your heirs upon your death. I advise clients to consider different options to own real estate, any of which may be more attractive depending on the client’s priorities. The two most frequent entity types are revocable trusts and limited liability companies (LLCs).

If an athlete’s primary concern is estate planning, a revocable trust can be the best real property ownership entity. This allows the athlete to maintain the house as if they own it themselves, even though the trust is the actual owner. Upon their death, the property continues to be owned by the trust, but the athlete’s children or other next of kin become the beneficiaries. This is frequently a common alternative for owning a home in someone’s individual capacity.

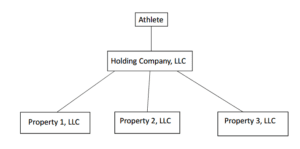

For commercial property, the most common ownership entity I advise is the LLC. This is particularly useful when the athlete owns multiple properties and wants to impose a more formal ownership structure. Under this model, each property is owned by a separate special purpose LLC (e.g., 101 Main Street LLC; 103 Main Street LLC; etc.), and the single member of each LLC is another LLC in which the athlete himself or herself is the member. The structure looks like this:

This has several benefits, including:

- It siloes liability for each property in the LLC that owns it;

- It allows the athlete to transfer title to multiple properties just by conveying his or her interest in the holding company; and

- Some brokers and appraisers believe that by holding multiple properties in one company, the appraised value of that company exceeds the total value of each individual property separately.

Both revocable trusts and LLCs require the preparation of legal documents in addition to any deeds to the properties, such as the declaration of trust and the limited liability company operating agreement. Both also require additional documentation when you want to use the property – sell it, lease it, use it as collateral, etc. That documentation may include a trustee certificate for the revocable trust and a resolution of the member and manager of the LLC.

There are, of course, other entities including corporations and other types of trusts, like a nominee trust. However, I find that those entity types either require even more legal documents (like annual meetings for the corporations) or are more likely to allow a litigant to pierce the entity’s liability shield, such as when the trustee of a nominee trust does not formally obtain the beneficiaries’ direction. Having said that, many clients prefer these entities for their particular concerns.

Additionally, there are tax consequences for each entity type above. Before an athlete takes title to real estate individually, in a trust, a LLC, etc., he or she should consult with their financial adviser, accountant, and attorney to receive appropriate advice about the type of ownership, potential liability, and tax issues.